Written by Edward Johnson

Edward is a Medical Writer at Alpharmaxim Healthcare Communications

The last few years have seen the expiration of multiple patents pertaining to several blockbuster biological drugs, dubbed the “patent cliff”, which is proving to be a fertile breeding ground for the development and approval of biosimilars. With increasing numbers of biosimilars being approved in Europe, what can they be expected to achieve?

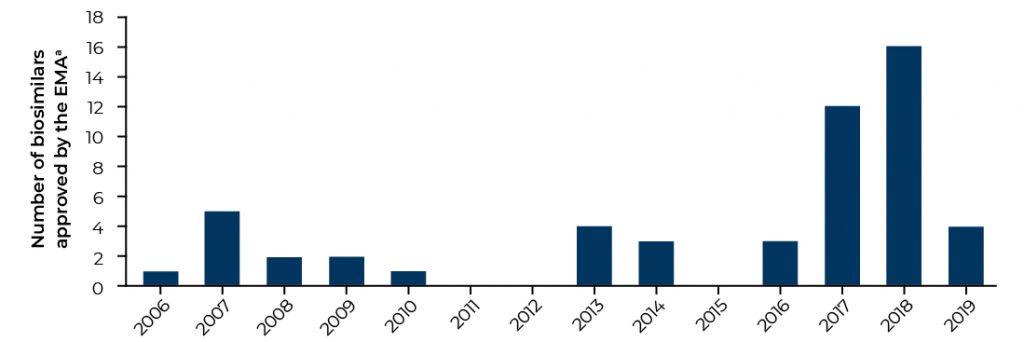

Europe is currently the most developed biosimilar market, with 53 biosimilar medicines approved as at Q3 2019 (Figure 1).¹ The boom in EMA-approved products in 2017 and 2018 greatly surpasses the number of approved biosimilars in the US, where the FDA has approved 23 biosimilar products as at Q3 2019.² The EMA was one of the first regulatory agencies to publish guidelines governing the development and testing of biosimilars, demonstrating both its keenness to encourage the uptake of biosimilars throughout Europe and the requirement for overarching regulation.

It is hard to look past the key selling points of biosimilars, which were conceived as cheaper biological medicines with equivalent efficacy, safety and immunogenicity profiles compared with their reference biological product. They have the potential to provide a greater number of therapeutic options to prescribers and patients, thus increasing patient access to therapies that may otherwise not be available due to a prohibitively high cost. These key selling points have not been lost on the NHS, who last year announced huge savings of approximately £300 million by switching to biosimilars of adalimumab.3 It appears that an increase in the number of procurement routes is one of the main reasons why the NHS was so keen to adopt biosimilars, as multiple sources of drug supply abolishes any manufacturer monopoly.

The introduction of multiple competitor products usually fosters a healthy market. The approval of five biosimilars to adalimumab in the EU in 2018 is by no means an exception. Many biosimilars are ready to pounce into the market upon the expiration of multiple blockbuster biologicals. A clear question arises from this scenario: what are the realistic market performance expectations for a biosimilar if it is surrounded by so many other biosimilars? Furthermore, the continuing sales and consumer perception of reference products cannot be ignored.

“There is great uncertainty in the overall adoption of biosimilars.”

The development of biosimilars is inherently expensive, as structural complexity and great variability in post-translational protein modifications mean that extensive characterisation and batch regulation are required.

The upshot is that it is inherently risky for manufacturers to develop biosimilars, especially when compared to the less complex route of development seen in small‑molecule generic drugs. However, the long-term financial incentives are too great for manufacturers to ignore, especially when considering the potentially lucrative fruits of the biologic patent cliff.

Perhaps the greatest uncertainty facing biosimilars resides with human decision: specifically, with prescribers and the patients themselves. Throughout Europe, the acceptance of biosimilars by prescribers has been highly varied; Germany has introduced a substitution plan and the UK has welcomed biosimilars with open arms, while most European nations do not currently allow biosimilar substitution at the pharmacy level. To date, it appears that biosimilars are mostly prescribed to biologic treatment-naive patients, mostly due to a lack of familiarity and concerns about immunogenicity and interchangeability. 4

While biosimilars may eventually be widely considered as a bona-fide money-saving enterprise, the current perception of biosimilars within the European healthcare setting may be a genuine hurdle for overall acceptance in the short term. Increasing educational awareness on the efficacy and safety of biosimilars will prove a key strategy to demonstrate cost-effectiveness, and to achieve long‑term and widespread acceptance.

References

1. European Medicines Agency (EMA). Approved medicines. https://www.ema.europa.eu/en/medicines/field_ema_web_categories%253Aname_field/Human/ema_group_types/ema_medicine/field_ema_med_status/authorised-36/ema_medicine_types/field_ema_med_biosimilar/search_api_aggregation_ema_medicine_types/field_ema_med_biosimilar?sort=field_ema_med_market_auth_date&order=desc

Accessed 16 September 2019

2. US Food and Drug Administration (FDA). Biosimilar product information. 23 July 2019. https://www.fda.gov/drugs/biosimilars/biosimilar-product-information. Accessed 16 September 2019

3. NHS England. NHS set to save record £300 million on the NHS’s highest drug spend. 26 November 2018. https://www.england.nhs.uk/2018/11/nhs-set-to-save-record-300-million-on-the-nhss-highest-drug-spend/. Accessed 16 September 2019

4. Leonard E, Wascovich M, Oskouei S, et al. Factors affecting health care provider knowledge and acceptance of biosimilar medicines: a systematic review. J Manag Care Spec Pharm 2019;25(1):102–112